Navigating cryptocurrency taxes doesn’t have to be stressful—especially with the right crypto tax software. These tools simplify the complexities of tracking transactions, calculating gains and losses, and staying compliant with tax regulations, saving you time and reducing errors.

In this post, we’ll explore the best crypto tax software available today, breaking down their features, pricing, and unique advantages. Whether you’re a casual trader or a seasoned investor with a diverse portfolio, this guide will help you choose the software that fits your needs and makes tax season hassle-free. Keep reading to discover the top solutions for managing your crypto taxes!

Table of Contents

Ease of Use

Ease of use is one of the most important factors when selecting crypto tax software. Whether you’re a beginner just getting started with cryptocurrency or a seasoned investor managing hundreds of transactions, an intuitive and user-friendly interface can make the tax preparation process much smoother.

Why Ease of Use Matters

Many cryptocurrency enthusiasts are not tax experts. A software tool that simplifies the process of importing transactions, organizing data, and generating tax reports is invaluable. An easy-to-navigate dashboard can save time, reduce frustration, and minimize the risk of errors. This is especially critical during tax season when deadlines are tight, and accurate filings are essential.

Features to Look For

When evaluating ease of use in crypto tax software, consider the following aspects:

- Intuitive Interface: A clean and well-organized dashboard that displays key features prominently.

- Guided Workflows: Step-by-step instructions for importing data, reviewing transactions, and generating reports.

- Automation: Automatic syncing with exchanges and wallets to reduce manual input.

- Error Detection: Alerts for missing data or discrepancies in your transaction history.

- Mobile Access: A responsive mobile app or web platform for on-the-go tracking and tax preparation.

Why It’s Important for You

If you’re new to crypto taxes, ease of use will directly impact your confidence in completing tax filings accurately. Even experienced investors benefit from software that reduces the workload and ensures compliance with regulations. A well-designed tool eliminates the steep learning curve associated with crypto tax filing and lets you focus on optimizing your returns.

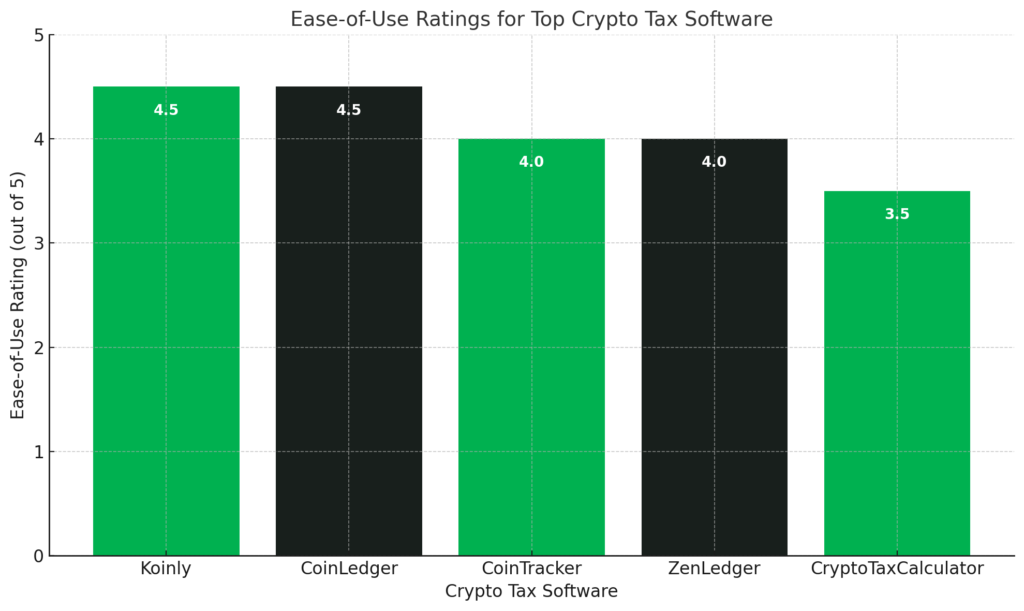

Visual Comparison of Ease-of-Use Ratings for Top Crypto Tax Software

Based on user reviews and ratings, here’s a visual comparison of the ease-of-use scores for various crypto tax software platforms:

Note: Ratings are based on user feedback and may vary.

This comparison highlights the user-friendliness of each platform, helping you choose the crypto tax software that best fits your needs.

By prioritizing ease of use, you can choose a crypto tax software solution that simplifies your tax filing process while ensuring accuracy and compliance.

Supported Exchanges and Wallets

The range of supported exchanges and wallets is a critical factor to consider when choosing the right crypto tax software. As cryptocurrency trading and investing involve multiple platforms, seamless integration ensures accurate reporting and reduces the time spent on manual data entry.

Why Supported Exchanges and Wallets Matter

Every transaction in your cryptocurrency portfolio—from buying, selling, staking, or transferring—must be accurately accounted for when filing taxes. If your crypto tax software doesn’t support the exchanges or wallets you use, you may face challenges importing transaction histories, leading to incomplete records and potential compliance issues.

For instance, if you trade on a niche exchange or hold assets in a less common wallet, you’ll need a tool that can handle those specific platforms. The broader the software’s support, the better it can cater to diverse portfolios.

Key Features to Look For

When comparing crypto tax software based on supported exchanges and wallets, consider these aspects:

- Wide Exchange Compatibility: The software should support popular centralized exchanges (like Binance, Coinbase, Kraken) and decentralized platforms.

- Wallet Integration: Compatibility with leading wallets such as MetaMask, Trust Wallet, and hardware wallets like Ledger and Trezor.

- API Integration: Automatic syncing via APIs to ensure real-time transaction updates.

- Manual Import Options: Support for CSV or manual imports in case an exchange or wallet is not natively integrated.

- Support for DeFi and NFTs: Advanced platforms should cater to transactions from decentralized finance protocols and NFT marketplaces.

Why It’s Important for You

A lack of exchange or wallet support can lead to data discrepancies and missing transactions, making it harder to generate accurate tax reports. Crypto traders who frequently use multiple exchanges and wallets benefit the most from software that offers comprehensive support. Additionally, broad compatibility allows for scalability as your crypto portfolio grows.

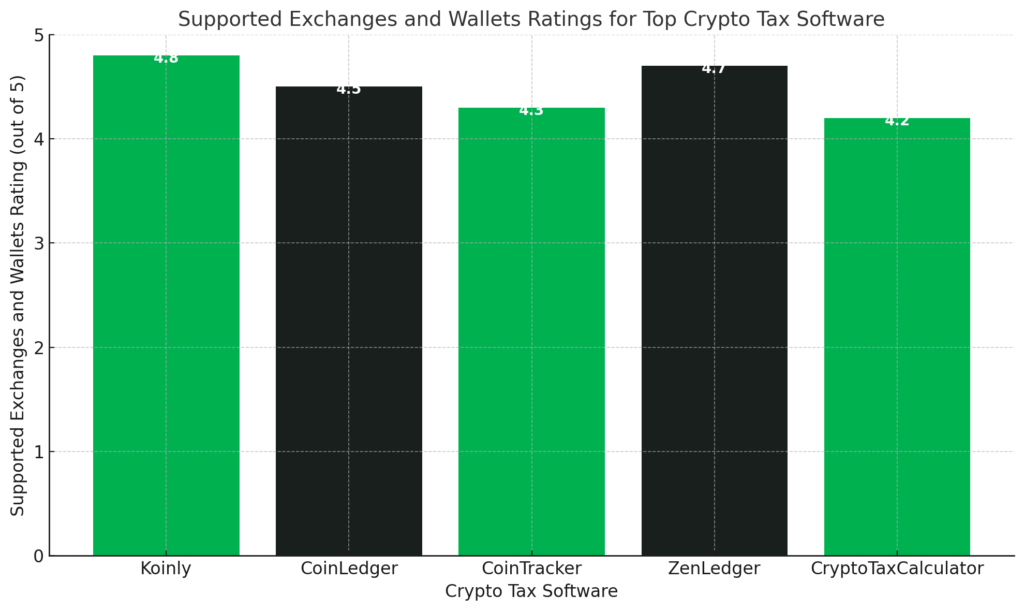

Supported Exchanges and Wallets Ratings for Crypto Tax Software

When selecting the best crypto tax software, compatibility with your preferred exchanges and wallets is a key factor. This bar chart illustrates the ratings for supported exchanges and wallets across five leading crypto tax software platforms, based on user reviews.

- Koinly leads the pack with a 4.8/5 rating, praised for its wide compatibility with both major and niche exchanges and wallets.

- ZenLedger follows closely with a 4.7/5 rating, offering robust integrations tailored to professional and advanced users.

- CoinLedger (Click Here to Save 10%) and CoinTracker provide strong support for most popular exchanges and wallets, earning ratings of 4.5 and 4.3, respectively.

- CryptoTaxCalculator has a solid 4.2/5 rating, appealing to users with diverse portfolios seeking comprehensive support.

This comparison highlights which tools excel at integrating with a wide range of platforms, ensuring seamless transaction tracking and accurate tax reporting.

Note: Ratings for Supported Exchanges and Wallets Among Top Crypto Tax Software Based on User Reviews.

By selecting crypto tax software with robust exchange and wallet support, you’ll ensure a smooth and efficient tax preparation process. Comprehensive support also provides peace of mind that every transaction in your portfolio is accounted for accurately.

Integration Options

Integration options are a key feature to evaluate when selecting the best crypto tax software. Effective integration ensures that your transaction data flows seamlessly from exchanges, wallets, and other platforms into the software, saving time and reducing the risk of errors.

Why Integration Options Matter

Managing cryptocurrency transactions manually can be overwhelming, especially for users with high trading volumes or complex portfolios. Software with robust integration capabilities simplifies the process by automating data collection and syncing it directly from your accounts. This reduces the chances of missing transactions or introducing errors through manual entry.

Additionally, strong integration options enable compatibility with tools you already use, such as accounting software or tax filing platforms, streamlining the entire reporting process.

Key Features to Look For

When evaluating crypto tax software for integration options, prioritize the following features:

- API Connectivity: Automatic synchronization with popular exchanges and wallets through APIs allows for real-time updates and eliminates the need for manual uploads.

- CSV Import Support: For platforms that don’t support API integration, the ability to upload transaction data via CSV files ensures no data is left out.

- Accounting Software Integration: Compatibility with accounting platforms like QuickBooks or Xero simplifies financial recordkeeping and reporting.

- Tax Filing Platform Support: Direct integration with tax filing software (e.g., TurboTax, H&R Block) allows you to export reports and file taxes without hassle.

- Multi-Platform Access: Synchronization across desktop, web, and mobile devices ensures that your data is accessible and consistent no matter how you work.

Why It’s Important for You

Crypto investors often operate across multiple platforms, so strong integration options reduce friction and ensure all transactions are captured accurately. API connectivity saves time by automating data syncing, while CSV imports provide a reliable fallback for less common platforms. Integration with accounting or tax filing software further streamlines the tax preparation process, making it easier to meet filing deadlines.

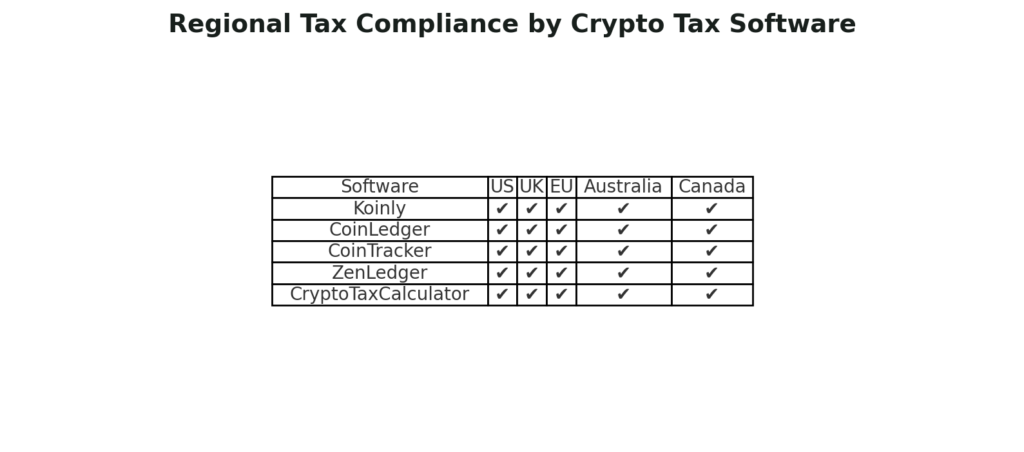

Regional Tax Compliance by Crypto Tax Software

Tax compliance varies across regions, and it’s critical to choose crypto tax software that supports your jurisdiction. This table highlights the regional coverage of the top software platforms, showing their compatibility with tax regulations in the US, UK, EU, Australia, and Canada. All five platforms—Koinly, CoinLedger (Only 50 Left at This Price!), CoinTracker, ZenLedger, and CryptoTaxCalculator—support these key regions, making them versatile solutions for global users.

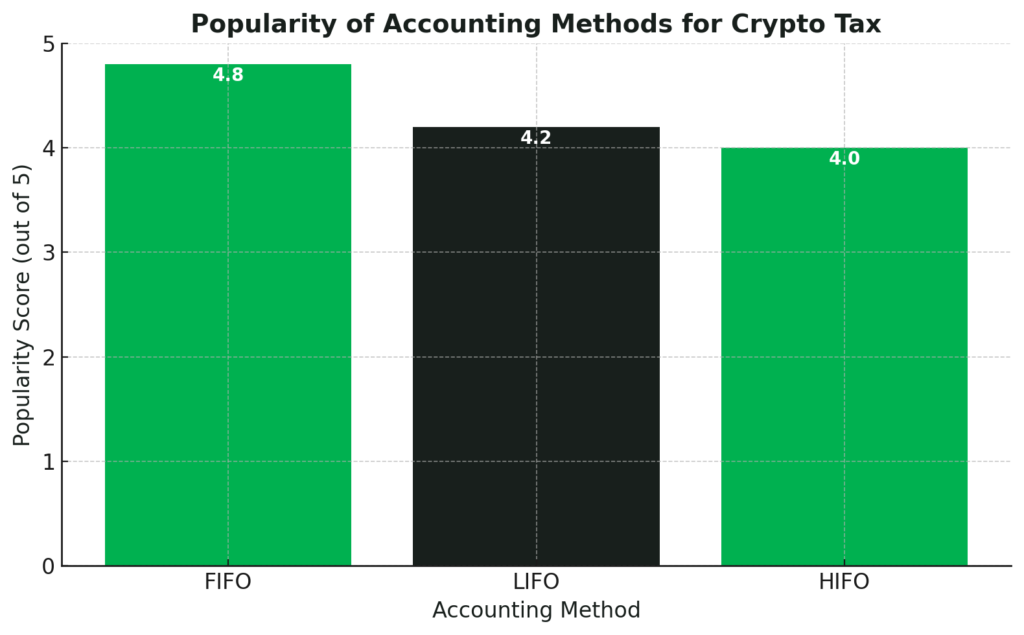

Popularity of Accounting Methods for Crypto Tax

Understanding accounting methods is crucial for accurate tax reporting. The bar chart above compares the popularity of three common methods:

- FIFO (First In, First Out): The most widely used method, scoring 4.8/5 for its simplicity and widespread acceptance by tax authorities.

- LIFO (Last In, First Out): Rated 4.2/5, LIFO can be beneficial for reducing taxable gains in certain situations but is less common globally.

- HIFO (Highest In, First Out): Scoring 4.0/5, HIFO is often used to minimize taxable gains but requires detailed tracking of acquisition costs.

This visual helps you understand how these methods rank in user preference and practical application.

By choosing crypto tax software with extensive integration options, you can save time, reduce errors, and enjoy a more streamlined tax preparation experience. The right integrations ensure all aspects of your crypto portfolio are accounted for, no matter how complex your trading history is.

Tax Compliance and Regulations

Tax compliance is one of the most crucial aspects of managing cryptocurrency investments, and the best crypto tax software should ensure your filings align with current regulations. As global tax authorities increase scrutiny on crypto transactions, staying compliant can help you avoid fines, audits, or other legal challenges.

Why Tax Compliance and Regulations Matter

Cryptocurrency tax laws vary widely by country, and they are constantly evolving. A reliable crypto tax software should adapt to these changes and provide accurate tax calculations based on your jurisdiction. Proper compliance involves reporting gains, losses, staking rewards, and other taxable events correctly, ensuring you fulfill your obligations while optimizing your tax outcomes.

Whether you’re filing taxes in the United States under the IRS guidelines, in the UK with HMRC, or in another country, crypto tax software must provide region-specific support.

Key Features to Look For

When evaluating crypto tax software for tax compliance and regulatory support, focus on the following features:

- Jurisdiction Support: Software should cater to specific tax laws in your country, including regional reporting requirements and tax brackets.

- Accounting Methods: Support for various accounting methods like FIFO (First In, First Out), LIFO (Last In, First Out), and others used in your jurisdiction.

- Updated Tax Rules: Regular updates to reflect changes in crypto tax policies, ensuring compliance with the latest regulations.

- Detailed Reporting: Generation of tax reports that clearly outline capital gains, losses, income, and deductions in an audit-friendly format.

- Audit Assistance: Some software tools offer additional resources, like audit protection or access to tax professionals, to guide you if the need arises.

Why It’s Important for You

Failing to comply with tax regulations can lead to penalties, interest charges, or audits. Crypto tax software with robust compliance features takes the guesswork out of reporting, helping you stay on top of changing laws and ensuring accurate filings. This is especially beneficial for users who trade frequently or engage in complex activities like DeFi, staking, or NFTs.

Recommended Image Suggestions

- Regional Tax Compliance Map: Include a map or table highlighting the regions supported by each crypto tax software.

- Accounting Method Comparison: Visualize the differences between FIFO, LIFO, and other accounting methods to help readers understand the options.

- Sample Tax Report: Show an example of a detailed tax report generated by the software, illustrating how gains and losses are calculated and presented.

By choosing crypto tax software that prioritizes tax compliance and adapts to changing regulations, you can confidently file accurate returns while staying within the bounds of the law. Comprehensive compliance features give you peace of mind, even as the crypto space evolves.

Cryptocurrency Types Supported

The range of cryptocurrency types supported is a vital feature when selecting crypto tax software. With the crypto market constantly evolving to include new coins, tokens, and asset types, the best crypto tax software must handle diverse transaction types and asset classes, ensuring accurate tax reporting.

Why Cryptocurrency Types Supported Matters

Crypto investors often hold a variety of assets, including well-known cryptocurrencies like Bitcoin and Ethereum, as well as altcoins, stablecoins, and newer categories like NFTs (non-fungible tokens) and DeFi (decentralized finance) tokens. Each of these asset types has unique tax implications, such as capital gains, staking rewards, or interest income from lending protocols.

Software that supports a broad range of cryptocurrency types ensures that every transaction—whether it’s a simple trade, an NFT purchase, or staking rewards—is accounted for correctly. Missing support for certain crypto types could result in incomplete tax reports, leading to compliance issues or penalties.

Key Features to Look For

When assessing cryptocurrency support in crypto tax software, consider the following:

- Diverse Token Coverage: Support for top cryptocurrencies, altcoins, and stablecoins across major blockchains like Bitcoin, Ethereum, Solana, and Binance Smart Chain.

- NFT Support: Capability to handle NFT-related transactions, including minting, buying, selling, and royalties.

- DeFi Transactions: Coverage for DeFi activities such as staking, liquidity mining, yield farming, and borrowing/lending protocols.

- Custom Token Import: Ability to manually add or import custom tokens that may not yet be widely recognized.

- Continuous Updates: Regular updates to include newly launched cryptocurrencies and blockchain technologies.

Why It’s Important for You

If your portfolio includes emerging or lesser-known crypto assets, using software that doesn’t support them could result in incomplete tax filings. Comprehensive support ensures that you can accurately track and report all transactions, avoiding unnecessary manual adjustments and potential errors. This is particularly important for active traders and DeFi users who frequently interact with newer asset types.

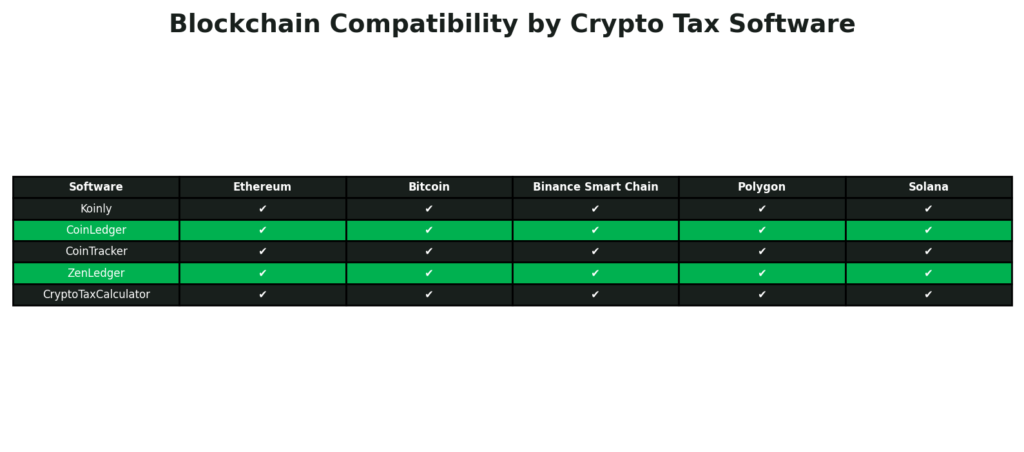

Blockchain Compatibility by Crypto Tax Software

By selecting crypto tax software that supports a wide variety of cryptocurrency types, you ensure that your tax reporting is accurate and complete, regardless of the complexity of your portfolio. Comprehensive support for traditional cryptocurrencies, NFTs, and DeFi transactions ensures you stay compliant while maximizing the efficiency of your tax filing process.

Blockchain compatibility is a critical feature of crypto tax software, as users often interact with multiple blockchain networks. This table highlights the support provided by leading platforms for key blockchains, including Ethereum, Bitcoin, Binance Smart Chain, Polygon, and Solana.

All platforms—Koinly, CoinLedger, CoinTracker, ZenLedger, and CryptoTaxCalculator—offer comprehensive blockchain coverage, ensuring seamless integration with diverse portfolios and transaction histories.

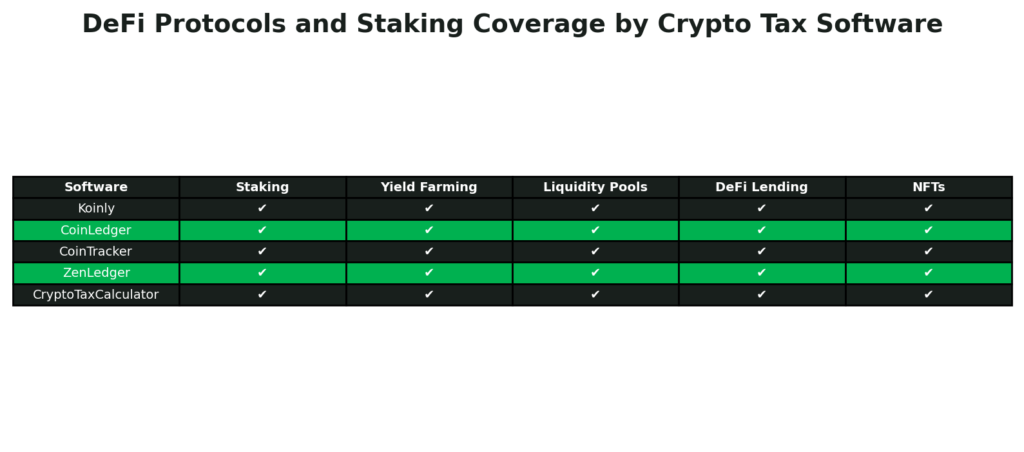

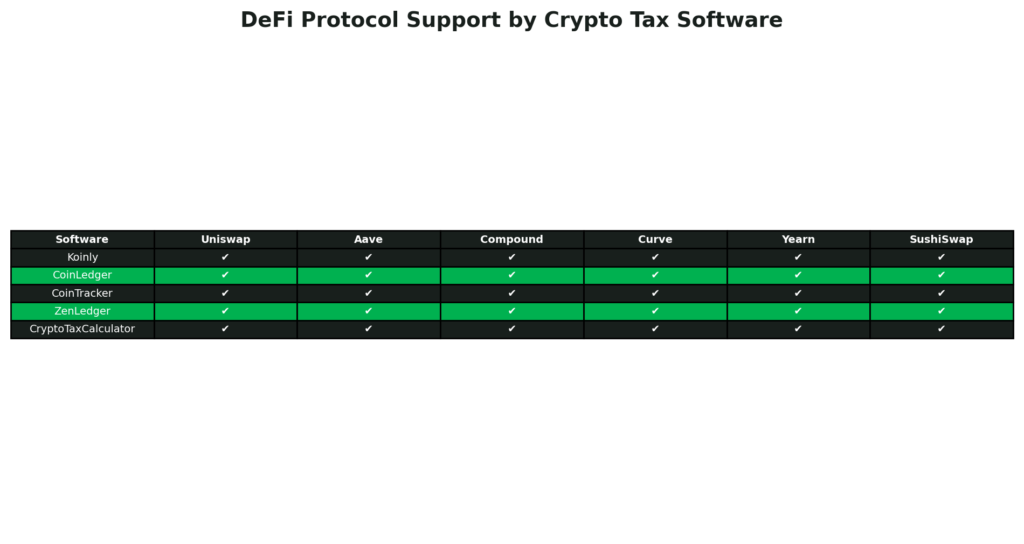

DeFi Protocols and Staking Coverage by Crypto Tax Software

DeFi activities and staking have unique tax implications, making support for these features essential in crypto tax software. The table compares how leading tools handle key activities, such as staking rewards, yield farming, liquidity pools, DeFi lending, and NFTs.

Each platform provides robust support for these protocols, making them reliable solutions for users engaging in complex DeFi and NFT transactions. Advanced users can confidently rely on any of these software options to capture and report their activities accurately.

Accuracy of Calculations

Accuracy of calculations is one of the most critical factors to consider when selecting crypto tax software. With the complex nature of cryptocurrency transactions—spanning trades, staking, DeFi activities, and NFTs—precision in calculations is essential to ensure compliance with tax regulations and avoid costly errors.

Why Accuracy of Calculations Matters

Crypto tax calculations involve determining the cost basis, fair market value, and gains or losses for each transaction. Mistakes in these calculations can result in underreporting or overreporting, leading to penalties, audits, or overpayment of taxes.

For example, discrepancies can arise if the software fails to account for transaction fees, misinterprets complex DeFi transactions, or applies the wrong accounting method. Accurate calculations save time and provide peace of mind by ensuring that your tax liability is correctly determined.

Key Features to Look For

When evaluating the accuracy of calculations in crypto tax software, consider the following:

- Cost Basis Tracking: The software should accurately calculate the cost basis for each transaction, considering factors like transaction fees and acquisition prices.

- Multiple Accounting Methods: Support for various accounting methods (e.g., FIFO, LIFO, HIFO) to align with your jurisdiction’s requirements.

- Error Detection: Built-in tools to identify discrepancies or missing data in transaction histories.

- DeFi and NFT Precision: The ability to handle complex transactions such as staking rewards, liquidity pools, yield farming, and NFT purchases.

- Tax Report Validation: Reports should be clear, detailed, and audit-friendly, with transparent calculations for gains, losses, and income.

Why It’s Important for You

Accurate calculations are non-negotiable for crypto investors, as errors can lead to financial losses or legal issues. Whether you’re filing taxes for a small portfolio or a high-volume trading account, accurate tax software eliminates guesswork and ensures compliance with tax authorities.

Furthermore, traders engaged in complex activities like DeFi or NFT transactions require software that can interpret and calculate these activities correctly. A tool that handles such intricacies reduces the need for manual intervention, saving time and effort.

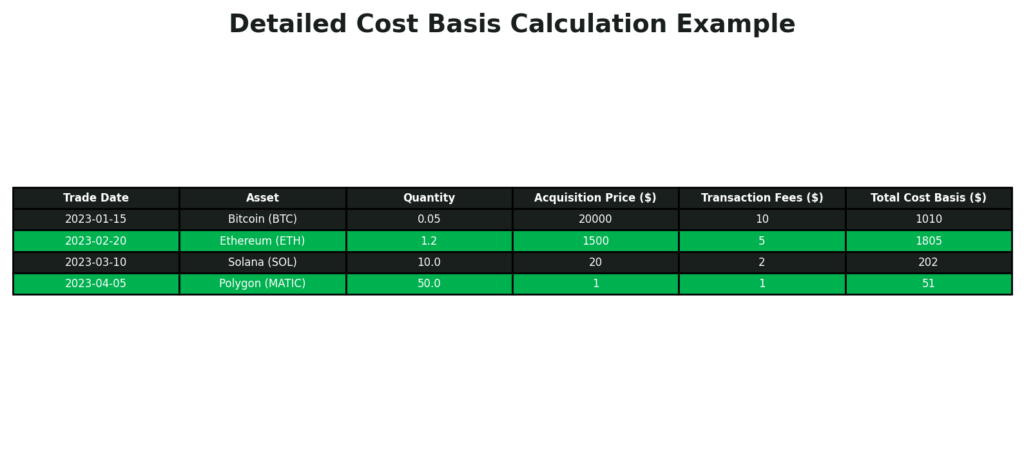

Cost Basis Calculation for Crypto Trades

Accurately calculating the cost basis for cryptocurrency trades is a crucial step in preparing tax reports. This example illustrates how crypto tax software determines the cost basis for a series of trades by factoring in acquisition prices and transaction fees.

Breakdown of Columns:

- Trade Date: The specific date the cryptocurrency was purchased or acquired.

- Asset: The name of the cryptocurrency involved in the trade (e.g., Bitcoin, Ethereum, Solana).

- Quantity: The amount of cryptocurrency purchased in each trade.

- Acquisition Price ($): The price per unit of the asset at the time of purchase.

- Transaction Fees ($): Fees paid for the transaction, including exchange and network fees.

- Total Cost Basis ($): The sum of the acquisition price and transaction fees, which forms the basis for calculating gains or losses.

Why It Matters

The cost basis is essential for determining your capital gains or losses when you sell or trade cryptocurrency. Platforms like Koinly, ZenLedger, and CoinLedger automate this process, ensuring accuracy and saving time. This is especially important for active traders or those dealing with high transaction volumes.

By selecting crypto tax software with robust and precise calculation features, you can confidently file accurate tax reports, avoid costly mistakes, and streamline your tax preparation process. Accuracy is the foundation of trust in any tax tool, making it an essential consideration for crypto traders and investors.

Pricing and Subscription Tiers

Pricing and subscription tiers are critical factors to evaluate when choosing crypto tax software. With a wide range of options available, understanding the cost structure and features included in each tier ensures you find a solution that fits your budget and meets your needs.

Why Pricing and Subscription Tiers Matter

The cost of crypto tax software can vary significantly depending on the number of transactions, supported features, and additional services like audit support or expert consultations. Selecting the right pricing tier can save you money while still providing the tools you need to simplify your tax filing.

For example, casual traders with minimal transactions may find free or low-cost plans sufficient, while high-volume traders or DeFi users may require premium plans with advanced features like multi-year reporting, complex transaction support, and integrations with professional accounting tools.

Key Features to Look For

When evaluating pricing and subscription tiers, consider the following factors:

- Free vs. Paid Plans: Many crypto tax software tools offer free plans with limited features. Evaluate if these meet your needs or if upgrading is necessary.

- Transaction Limits: Plans often have caps on the number of transactions supported. Ensure the tier you choose can handle your trading volume.

- Features by Tier: Higher-priced plans typically include advanced features like API integrations, DeFi and NFT support, or detailed tax reports.

- Additional Services: Premium plans may include audit assistance, expert consultations, or integrations with tax filing software like TurboTax.

- Scalability: Check if the software allows you to upgrade plans easily as your transaction volume or portfolio complexity grows.

Why It’s Important for You

Understanding pricing and subscription tiers helps you balance cost and functionality. Overpaying for features you don’t need can waste resources, while opting for an underpowered plan could result in incomplete or inaccurate tax reporting. Selecting the right tier ensures that you only pay for what you use, while still enjoying the benefits of reliable crypto tax software.

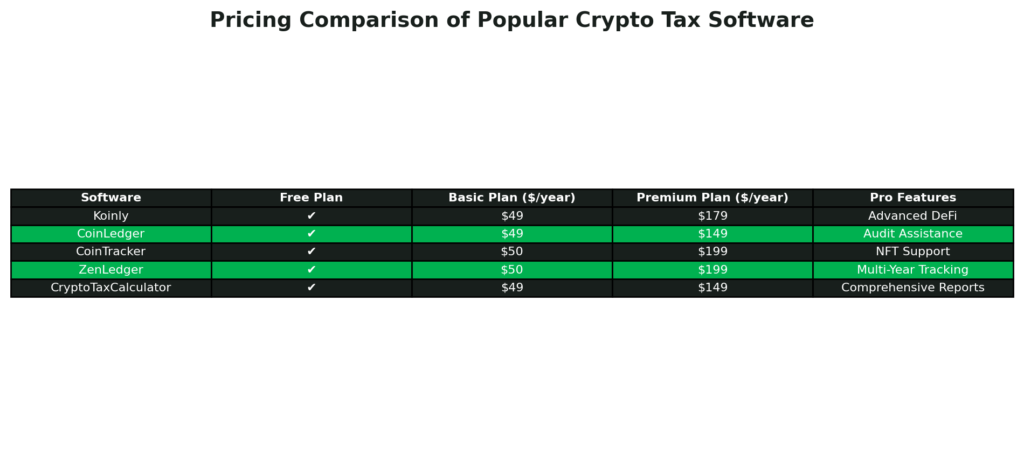

Pricing Comparison of Popular Crypto Tax Software

Selecting the right crypto tax software involves understanding the pricing and features offered at each subscription tier. This table compares the pricing structures of leading platforms, including their free, basic, and premium plans:

- Free Plan: All platforms offer a free plan, ideal for users with minimal transactions or simple reporting needs.

- Basic Plan: Starting at $49–$50 per year, these plans include essential features like basic transaction tracking and tax filing integrations, suitable for casual traders.

- Premium Plan: Ranging from $149 to $199 annually, premium plans provide advanced features such as multi-year tracking, audit assistance, DeFi support, and NFT tracking.

Each software varies slightly in the features provided at each level, so it’s important to choose a plan that aligns with your specific requirements and trading volume.

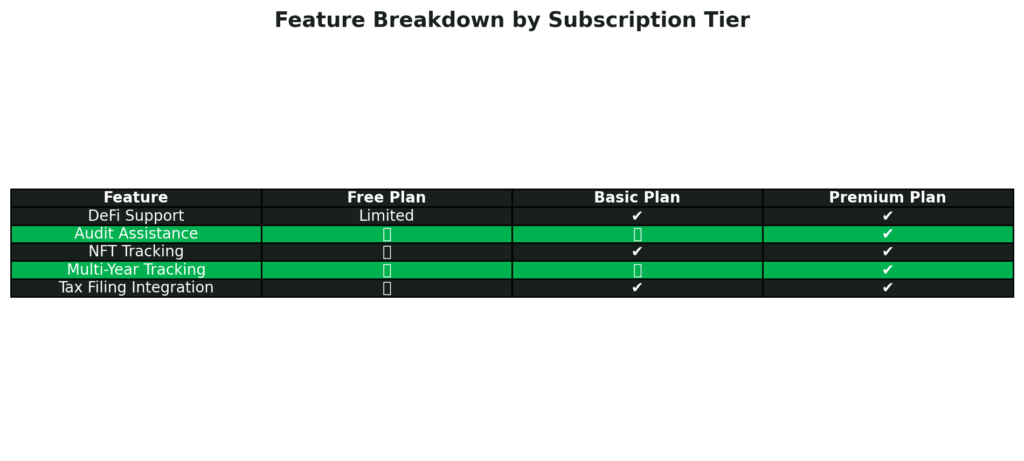

Feature Breakdown by Subscription Tier

The features offered by crypto tax software often vary based on the subscription tier. This table highlights the key capabilities included in free, basic, and premium plans:

- Free Plan: Offers limited functionality, typically excluding advanced features like audit assistance and NFT tracking.

- Basic Plan: Includes essential tools such as DeFi support and basic tax filing integrations, making it suitable for most users with straightforward portfolios.

- Premium Plan: Unlocks all advanced features, including multi-year tracking, comprehensive reporting, and audit readiness, catering to active traders and those with complex portfolios.

This breakdown helps you understand which subscription level provides the tools you need for efficient and accurate tax filing.

By comparing pricing and subscription tiers, you can identify the crypto tax software that offers the best value for your specific situation. Whether you’re a casual trader or an active investor with complex transactions, choosing the right plan ensures you get the features you need without overspending.

Customer Support

Customer support is a critical feature to evaluate when choosing crypto tax software. Whether you’re a beginner navigating crypto tax filing for the first time or a seasoned investor with a complex portfolio, having access to reliable support can make all the difference in resolving issues quickly and effectively.

Why Customer Support Matters

The crypto tax process can be complicated, involving multiple exchanges, wallets, and transaction types. Issues such as data import errors, unclear calculations, or technical glitches can arise, making responsive and knowledgeable customer support essential. Access to timely assistance ensures you can resolve these problems without delays, especially during tax season when deadlines are tight.

Good customer support also builds trust, as it demonstrates the company’s commitment to helping users succeed with their crypto tax filings.

Key Features to Look For

When evaluating customer support for crypto tax software, consider the following factors:

- Availability: Check if support is available 24/7 or only during specific hours. Round-the-clock support can be critical for global users or last-minute issues.

- Support Channels: Look for multiple support options such as live chat, email, phone support, and an extensive knowledge base.

- Response Time: Evaluate how quickly the support team responds to inquiries. Prompt responses are particularly important during high-pressure situations like tax season.

- Expert Assistance: Some platforms offer access to tax professionals or specialists who can provide personalized advice or audit assistance.

- Community and Resources: Additional resources like forums, FAQs, and tutorial videos can help users troubleshoot common issues independently.

Why It’s Important for You

Strong customer support can save you time and frustration by providing clear solutions to technical or tax-related issues. For complex crypto transactions, having access to a knowledgeable support team ensures that errors are resolved correctly, helping you maintain compliance with tax regulations. Beginners especially benefit from platforms with robust support, as they may encounter more challenges navigating the software.

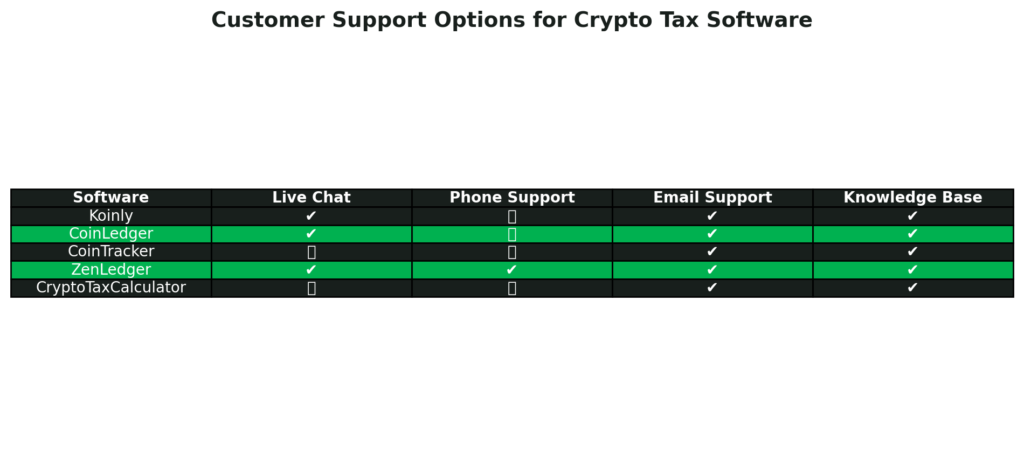

Customer Support Options for Crypto Tax Software

Effective customer support is an essential feature of crypto tax software, especially for users dealing with complex transactions or unfamiliar tax requirements. This table highlights the support channels available across leading platforms, helping you identify the software that offers the assistance you need:

Support Channel Breakdown:

- Live Chat: Platforms like Koinly, CoinLedger, and ZenLedger offer live chat support, providing users with real-time assistance. This feature is particularly valuable for resolving urgent issues during tax season.

- Phone Support: Only ZenLedger provides phone support, making it an excellent choice for users who prefer direct, verbal communication with a representative.

- Email Support: All platforms provide email support, ensuring a reliable way to contact their teams for help, regardless of subscription tier.

- Knowledge Base: Comprehensive knowledge bases are available on all platforms, offering guides, FAQs, and tutorials to empower users to resolve common issues independently.

Why Customer Support Matters

Strong customer support ensures that users can navigate challenges effectively, from technical difficulties to complex tax queries. Platforms with multiple support channels, such as live chat and phone support, stand out for their ability to provide timely and tailored assistance.

By choosing crypto tax software with reliable customer support, you can confidently navigate the complexities of crypto tax filing, knowing help is available when you need it. Excellent support ensures a smoother experience and gives you peace of mind as you work through your tax obligations.

Security Features

When dealing with sensitive financial data, the security features of crypto tax software are a top priority. Cryptocurrency investors must ensure that their chosen software provides robust security measures to protect personal and transactional information from breaches, unauthorized access, and data misuse.

Why Security Features Matter

Crypto tax software requires access to sensitive information, such as exchange credentials, wallet addresses, and financial details. A lack of strong security measures can leave your data vulnerable to cyberattacks, phishing, or unauthorized usage. Ensuring the safety of your data not only protects your financial assets but also provides peace of mind as you file taxes.

Robust security features demonstrate the software provider’s commitment to safeguarding user information, which is especially crucial in the fast-evolving world of cryptocurrency.

Key Security Features to Look For

When evaluating crypto tax software, consider these essential security features:

- Data Encryption: The software should use advanced encryption protocols, such as SSL (Secure Socket Layer), to protect data during transmission and storage.

- Two-Factor Authentication (2FA): 2FA adds an extra layer of security by requiring a second verification step (e.g., a one-time code sent to your phone) when logging in.

- API Key Security: If the software uses API connections to exchanges, ensure the API keys are stored securely and only require read-only access.

- Privacy Compliance: The platform should comply with major privacy regulations, such as GDPR (General Data Protection Regulation) or CCPA (California Consumer Privacy Act), to ensure proper handling of user data.

- Regular Security Audits: Platforms that undergo regular third-party security audits provide additional assurance of their safety standards.

- Access Controls: Features that allow you to manage and restrict access to your account or data, such as role-based access for team members or advisors.

Why It’s Important for You

Choosing crypto tax software with strong security features minimizes the risk of data breaches and identity theft. As cryptocurrency adoption grows, so does the threat landscape, making security a non-negotiable aspect of any software handling your financial information. For both individual investors and institutional users, robust security ensures that your crypto tax filing process is safe and compliant.

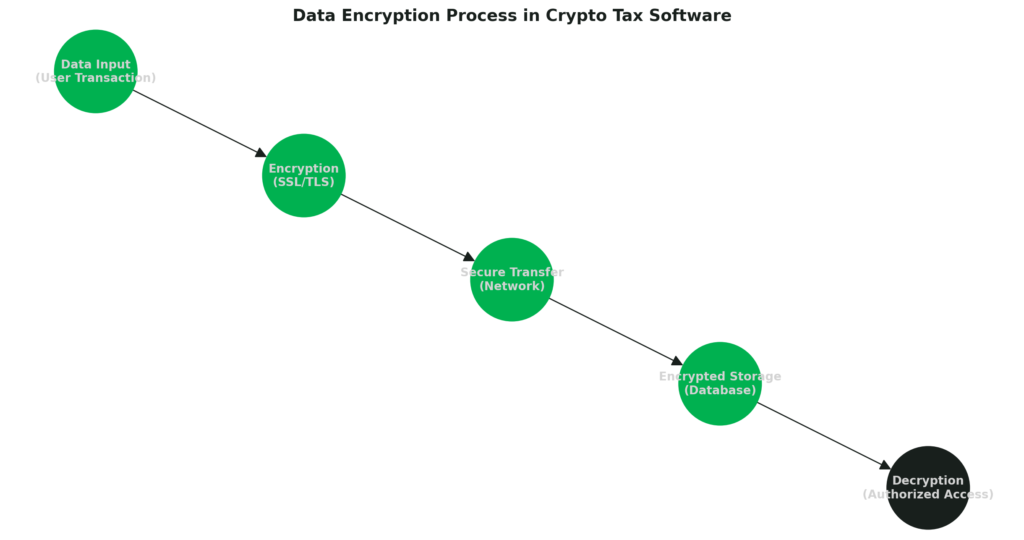

How Data Encryption Works in Crypto Tax Software

Data security is a top priority for crypto tax software, given the sensitive financial information it handles. This diagram illustrates the encryption process used to protect data during transfer and storage:

Step-by-Step Encryption Process:

- Data Input (User Transaction):

Users provide sensitive data, such as transaction details or exchange API keys, which are immediately queued for encryption to ensure security. - Encryption (SSL/TLS):

The software encrypts the data using robust protocols like SSL/TLS (Secure Socket Layer/Transport Layer Security). This process converts the data into an unreadable format, safeguarding it during transmission. - Secure Transfer (Network):

Encrypted data is securely transmitted over the network, preventing interception or unauthorized access by third parties during the transfer process. - Encrypted Storage (Database):

Once received, the data is stored in an encrypted format within the software’s database. This ensures long-term security, even if the storage system is accessed maliciously. - Decryption (Authorized Access):

Only authorized users or systems with the correct credentials can decrypt the data. This ensures privacy and prevents unauthorized access to sensitive information.

Why Encryption Matters

Strong encryption ensures that sensitive financial and personal data remains protected from breaches, unauthorized access, and cyberattacks. By implementing encryption at every stage—transfer, storage, and access—crypto tax software builds trust and ensures compliance with data protection regulations like GDPR and CCPA.

By selecting crypto tax software with advanced security features, you can confidently manage your tax filings without worrying about data breaches or unauthorized access. Security is the backbone of trust, and ensuring your chosen platform prioritizes it will make your crypto tax journey both safe and efficient.

Customizable Reporting

Customizable reporting is an essential feature to consider when selecting crypto tax software. With cryptocurrency portfolios varying widely in complexity, having the ability to tailor reports to your specific needs can simplify tax filing, financial analysis, and compliance with local regulations.

Why Customizable Reporting Matters

Cryptocurrency investors and traders engage in diverse activities, from simple trades to staking, liquidity mining, and NFT transactions. Tax implications for each of these activities differ, and a one-size-fits-all report may not meet your requirements. Customizable reporting allows you to generate detailed, accurate, and context-specific tax documents that align with your financial situation.

Additionally, customizable reports help accountants or tax professionals quickly identify relevant information, saving time and reducing errors.

Key Features to Look For

When evaluating crypto tax software for customizable reporting, consider these features:

- Report Types: The software should offer various report types, such as capital gains/losses, income reports (e.g., staking rewards, airdrops), and expense tracking.

- Export Formats: Look for flexibility in exporting reports in formats like PDF, CSV, or Excel, making it easy to share with tax professionals or integrate with other tools.

- Tax Year Adjustments: Ability to generate reports for different tax years, including amended filings or multi-year tracking.

- Advanced Filtering: Custom filters to sort transactions by type, date, or asset, allowing you to focus on specific aspects of your portfolio.

- Country-Specific Templates: Pre-formatted reports tailored to meet the requirements of specific tax authorities, such as the IRS (US) or HMRC (UK).

Why It’s Important for You

Customizable reporting ensures that your tax documentation is both comprehensive and precise. Whether you need a detailed breakdown of specific transaction types or a summary of your overall portfolio, customizable options save time and help you stay compliant with tax regulations. For businesses or high-volume traders, this flexibility can significantly streamline the tax filing process.

Recommended Image Suggestions

- Sample Custom Report: Include a screenshot of a customizable report interface, showing how users can select report types, filters, and formats.

- Export Options Visual: Highlight different export format options (e.g., PDF, CSV, Excel) with a graphic or menu screenshot.

- Comparison Chart: Create a table comparing the customizable reporting features of popular crypto tax software, emphasizing report types and flexibility.

By choosing crypto tax software with robust customizable reporting features, you can tailor your tax documents to match your unique portfolio and filing requirements. This flexibility ensures accuracy, saves time, and simplifies collaboration with tax professionals.

Audit Support

Audit support is a crucial feature to consider when selecting crypto tax software, especially as tax authorities worldwide increase their scrutiny of cryptocurrency transactions. The right software can help you prepare for and respond to audits with confidence, ensuring compliance and accuracy in your filings.

Why Audit Support Matters

Cryptocurrency trading and investing involve a wide variety of transactions, including trades, staking rewards, airdrops, and NFT activities. The complexity of these transactions makes them more prone to errors, omissions, or misreporting, which can trigger an audit.

Audit support ensures that you have access to detailed and well-organized reports, as well as expert assistance if needed. This feature can save you time, reduce stress, and help you avoid penalties during an audit.

Key Features to Look For

When evaluating crypto tax software for audit support, consider these key features:

- Comprehensive Audit Reports: The software should generate detailed, audit-ready reports that clearly document every transaction, gain, and deduction.

- Access to Tax Experts: Some platforms offer access to in-house tax professionals who can guide you through an audit or help you resolve discrepancies.

- Transaction History Documentation: The ability to retrieve and provide a complete transaction history ensures you can respond accurately to tax authority inquiries.

- Error Detection Tools: Built-in tools that flag potential discrepancies or missing data before filing can reduce the risk of audits.

- Guidance for Audit Preparation: Resources such as step-by-step guides, FAQs, or personalized consultations to help you prepare for an audit effectively.

Why It’s Important for You

Facing a tax audit can be intimidating, but having the right tools and support can make the process manageable. Crypto tax software with robust audit support minimizes the risk of errors in your tax filings and provides the necessary documentation to defend your position if an audit occurs. For frequent traders or those involved in complex activities like DeFi, this feature is especially valuable.

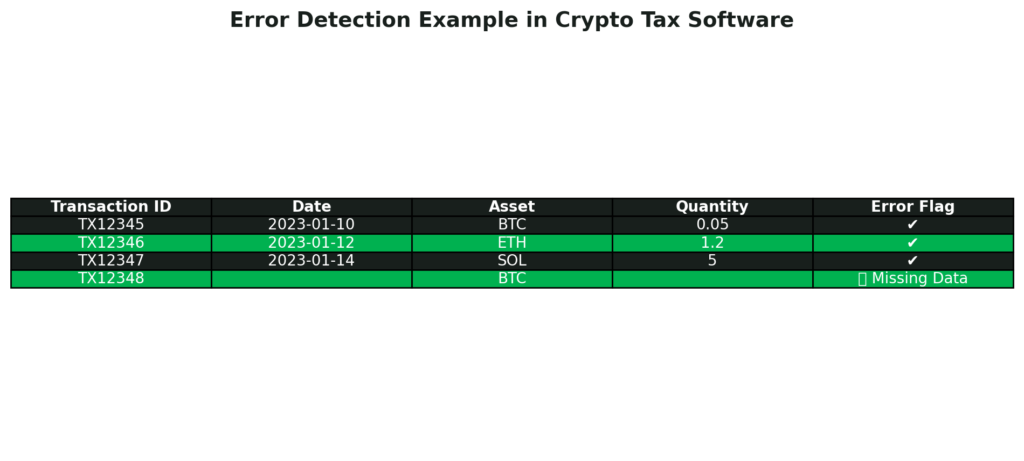

How Crypto Tax Software Detects and Flags Errors

Accurate transaction data is critical for ensuring compliance and avoiding discrepancies during tax filing. This table illustrates how crypto tax software identifies errors in transaction records, guiding users to correct issues before generating reports.

Key Features of Error Detection:

- Automated Validation: The software reviews each transaction for completeness and consistency, flagging any discrepancies.

- Error Flags:

- ✔️ Correct Data: Indicates that all required fields are properly filled and consistent.

- ❌ Missing Data: Highlights missing or incorrect fields, such as incomplete dates, missing quantities, or unsupported assets.

- User Guidance: Once an error is flagged, the software provides actionable insights or steps for correction, ensuring all transactions meet compliance standards.

Example Scenario:

- Transaction ID TX12348:

- Missing both the Date and Quantity fields.

- The software flags the row with a red ❌, prompting the user to input the missing information before proceeding with tax calculations.

Why Error Detection Matters

This feature is essential for preventing errors that could lead to incorrect tax reports or audits. By addressing issues during the data input phase, crypto tax software ensures accuracy, saves time, and builds user confidence in the filing process.

By selecting crypto tax software with robust audit support, you gain peace of mind knowing you’re prepared for any scrutiny from tax authorities. From generating detailed reports to providing expert assistance, these features ensure you can handle audits confidently and efficiently.

DeFi and NFT Support

Support for decentralized finance (DeFi) and non-fungible tokens (NFTs) is becoming an essential feature of crypto tax software. As these sectors grow in popularity and complexity, the ability to accurately track and report transactions involving DeFi protocols and NFTs ensures your tax filings remain compliant with regulations.

Why DeFi and NFT Support Matters

DeFi and NFTs have unique tax implications compared to traditional cryptocurrency trades. Activities like staking, yield farming, liquidity pooling, borrowing, and lending generate taxable events that require specialized reporting. Similarly, NFT transactions—whether you’re buying, selling, minting, or earning royalties—often involve intricate calculations due to fluctuating market values and transaction fees.

Many general-purpose crypto tax tools struggle to keep up with these complexities, leading to potential inaccuracies in reporting. Crypto tax software with dedicated DeFi and NFT support simplifies this process, ensuring all taxable events are captured and reported correctly.

Key Features to Look For

When evaluating crypto tax software for DeFi and NFT support, look for these capabilities:

- DeFi Transaction Tracking: Ability to track staking rewards, yield farming gains, liquidity pool contributions, and income from lending protocols across major blockchain networks like Ethereum, Binance Smart Chain, and Solana.

- NFT Transaction Management: Support for minting, buying, selling, and earning royalties from NFTs, with accurate cost basis and gains/losses calculations.

- Complex Fee Handling: Accurate accounting for gas fees and other transaction costs associated with DeFi and NFT activities.

- Multi-Chain Support: Compatibility with a wide range of blockchains and DeFi platforms, ensuring comprehensive coverage of your portfolio.

- Real-Time Updates: Integration with DeFi protocols and NFT marketplaces to sync data automatically and stay updated on your portfolio’s activity.

Why It’s Important for You

If you participate in DeFi or NFT activities, using crypto tax software with dedicated support for these transactions ensures that your tax reports are both accurate and compliant. Given the complexity of these activities, manual tracking is time-consuming and prone to errors. Proper DeFi and NFT support simplifies the process, saving time and reducing the risk of penalties due to misreporting.

DeFi Protocol Support by Crypto Tax Software

DeFi transactions are inherently complex, involving activities like lending, borrowing, staking, and liquidity provision. Comprehensive support for DeFi protocols is essential in crypto tax software to ensure accurate tracking and reporting of these transactions. This chart compares the DeFi platform support offered by leading tools, including Koinly, CoinLedger, CoinTracker, ZenLedger, and CryptoTaxCalculator.

Supported DeFi Protocols:

- Uniswap: As one of the largest decentralized exchanges, Uniswap is fully supported by all platforms, allowing seamless tracking of swaps and liquidity pool activities.

- Aave: Lending and borrowing activities on Aave are supported across all platforms, ensuring accurate tracking of interest and rewards.

- Compound: Transactions from Compound, another leading DeFi protocol, are fully covered, making it easy to report lending and borrowing income.

- Curve: With its focus on stablecoin liquidity pools, Curve is supported by all platforms for precise reporting of yield farming activities.

- Yearn: Advanced yield farming strategies on Yearn are tracked and reported accurately, simplifying tax calculations for DeFi enthusiasts.

- SushiSwap: Like Uniswap, SushiSwap’s trading and liquidity provision activities are fully supported across the board.

Why This Matters

DeFi participation often generates taxable events, such as interest earned, rewards received, and capital gains or losses from trades. Having crypto tax software that supports major protocols ensures:

- Accuracy: Transactions are tracked and reported correctly.

- Time Savings: Automated tracking reduces manual data entry for complex activities.

- Compliance: Proper reporting minimizes the risk of audits or penalties.

Whether you’re actively engaging in DeFi or just starting, choosing a platform with robust DeFi support simplifies your tax filing process and ensures compliance.

By choosing crypto tax software with robust DeFi and NFT support, you can confidently manage your tax filings, even if your portfolio involves advanced and emerging asset classes. This ensures compliance, accuracy, and efficiency in handling the unique challenges posed by DeFi and NFTs.

Multi-Year Tracking

Multi-year tracking is an essential feature in crypto tax software, allowing users to efficiently manage transaction records and ensure compliance across multiple tax years. This capability is particularly valuable for long-term investors and active traders who need to track historical data for accurate reporting, tax-loss harvesting, or filing amended returns.

Why Multi-Year Tracking Matters

Cryptocurrency transactions often span several tax years, with implications for long-term capital gains, cost basis continuity, and loss carryforwards. Without a robust multi-year tracking system, it can be challenging to maintain consistent and accurate tax records.

For example, if you purchase a cryptocurrency in one year and sell it several years later, multi-year tracking ensures the cost basis and holding period are accurately calculated to determine short- or long-term capital gains. This feature is also crucial for identifying and carrying forward losses or reconciling prior-year errors during audits or amended filings.

Key Features to Look For

When evaluating crypto tax software for multi-year tracking, prioritize these features:

- Historical Data Management: Ability to import and store transaction histories from previous years for continuity.

- Loss Carryforward Tracking: Automatic calculation and application of losses that can be carried forward to offset future gains.

- Cost Basis Adjustments: Accurate tracking of cost basis across tax years, accounting for events like splits, mergers, or staking rewards.

- Amended Return Support: Tools to generate updated reports for filing amended tax returns when corrections are needed for prior years.

- Comprehensive Yearly Summaries: Summary reports for each tax year, providing a clear breakdown of gains, losses, and taxable income.

Why It’s Important for You

For both casual investors and active traders, multi-year tracking is critical for staying compliant with tax regulations and optimizing tax strategies. It ensures accuracy in reporting, reduces manual effort in managing historical data, and simplifies the process of filing amended returns if needed. This feature is especially beneficial for high-volume traders or those with complex portfolios, as it reduces the risk of errors and simplifies audits.

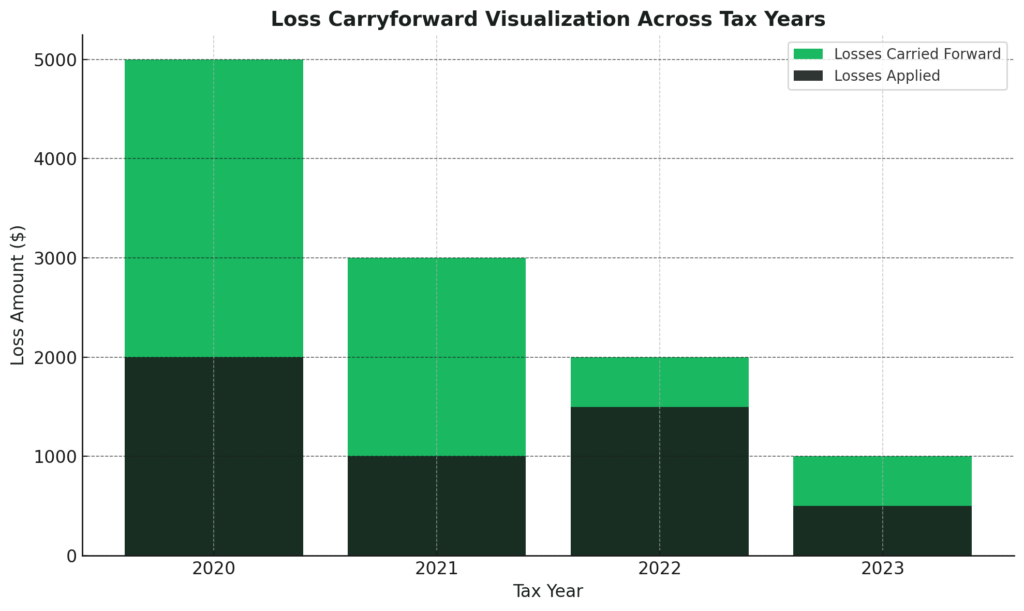

Loss Carryforward Visualization Across Tax Years

This bar chart demonstrates how crypto tax software tracks and applies losses across tax years. The green bars represent the total losses carried forward, while the black bars indicate the portion of those losses applied to offset taxable gains in each year.

- 2020: $5,000 loss carried forward, $2,000 applied.

- 2021: $3,000 carried forward, $1,000 applied.

- 2022: $2,000 carried forward, $1,500 applied.

- 2023: $1,000 carried forward, $500 applied.

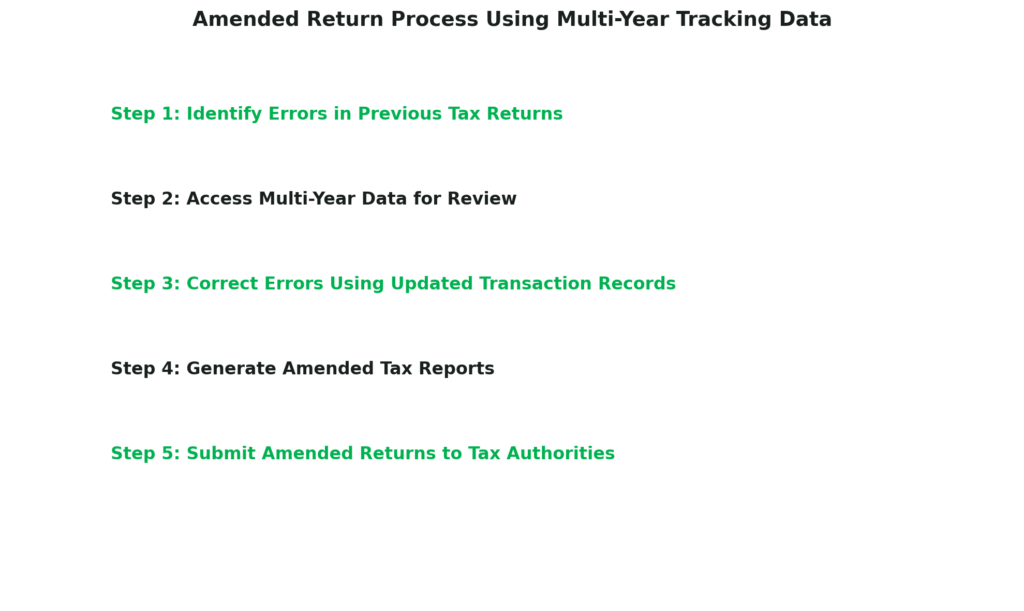

Amended Return Process Using Multi-Year Tracking Data

This step-by-step workflow illustrates how crypto tax software facilitates the generation of amended tax returns:

- Identify Errors in Previous Tax Returns: Locate discrepancies or missing data in previously filed reports.

- Access Multi-Year Data for Review: Use the software’s multi-year tracking feature to analyze transaction history.

- Correct Errors Using Updated Transaction Records: Adjust records based on new or corrected data.

- Generate Amended Tax Reports: Create accurate amended reports for resubmission.

- Submit Amended Returns to Tax Authorities: File the revised returns to the appropriate tax agency.

The combination of loss carryforward tracking and multi-year data review ensures users can efficiently address errors and optimize their tax outcomes.

This visualization highlights how the remaining losses are managed year over year to reduce taxable income, a critical feature for optimizing tax strategies.

By choosing crypto tax software with multi-year tracking, you gain a powerful tool for maintaining accurate tax records, optimizing your tax strategy, and ensuring compliance over time. This feature is a must-have for anyone with a long-term investment approach or a complex crypto portfolio.

User Reviews and Reputation

When selecting the best crypto tax software, user reviews and the reputation of the platform are critical factors to consider. They provide valuable insights into the software’s performance, reliability, and overall user satisfaction, helping you make an informed decision.

Why User Reviews and Reputation Matter

Crypto tax software handles sensitive financial information and plays a significant role in ensuring tax compliance. Trusting a platform with a proven track record and positive feedback from real users reduces the risk of encountering issues like inaccurate calculations, poor support, or security concerns.

User reviews often highlight aspects of the software that may not be immediately obvious, such as ease of use, response times for customer support, or integration challenges. By researching reviews and evaluating reputation, you can identify platforms that consistently deliver reliable results and excellent user experiences.

Key Aspects to Evaluate in Reviews

When assessing user reviews and the reputation of crypto tax software, focus on these areas:

- Accuracy and Reliability: Look for reviews that confirm the software’s ability to handle complex crypto transactions and generate accurate tax reports.

- Ease of Use: Identify feedback about the software’s interface, setup process, and navigation, particularly for first-time users.

- Customer Support Quality: Pay attention to comments on the responsiveness and helpfulness of customer support.

- Security Confidence: Users often mention how secure they feel using the platform to store sensitive data, which can provide reassurance.

- Performance Consistency: Reputation is built over time, so favor platforms with a long-standing history of positive reviews rather than those with only recent feedback.

Where to Find Reliable Reviews

- Review Platforms: Websites like Trustpilot, G2, and Capterra provide detailed user reviews and star ratings for crypto tax software.

- Crypto Communities: Forums like Reddit and Telegram groups often contain user discussions about their experiences with different platforms.

- Social Media: Twitter and LinkedIn can provide quick insights into user sentiment about specific crypto tax tools.

Why It’s Important for You

Evaluating user reviews and reputation ensures that you select crypto tax software that meets your expectations and provides value for your investment. Platforms with strong reputations are more likely to deliver consistent performance, reliable support, and accurate results, giving you peace of mind during the tax filing process.

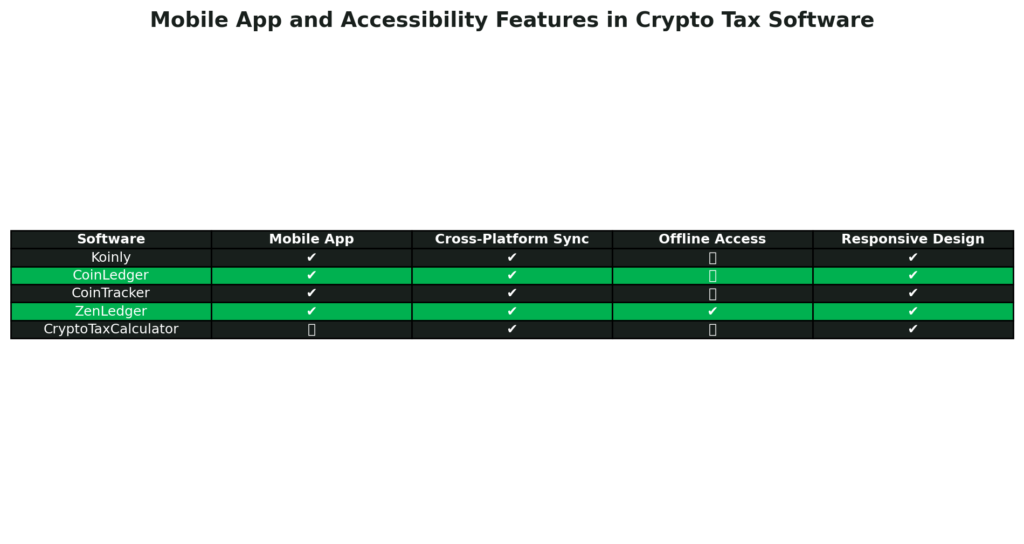

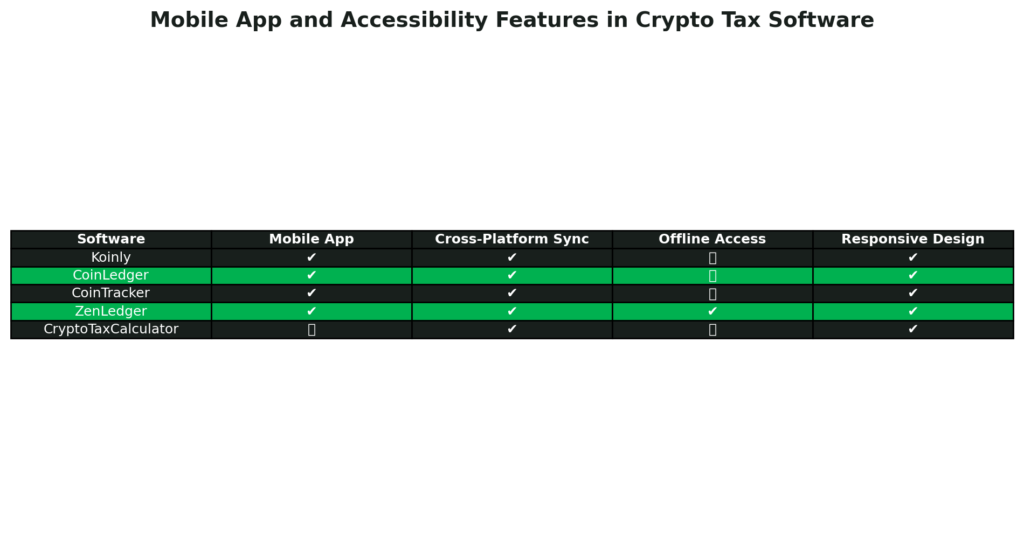

Mobile App and Accessibility Features in Crypto Tax Software

This table compares the mobile app and accessibility features of leading crypto tax software platforms, highlighting key capabilities that enhance user convenience:

Feature Breakdown:

- Mobile App: Most platforms, including Koinly, CoinLedger, CoinTracker, and ZenLedger, provide mobile apps for on-the-go access. CryptoTaxCalculator does not currently offer a mobile app.

- Cross-Platform Sync: All platforms support synchronization across desktop, web, and mobile devices, ensuring consistent data accessibility.

- Offline Access: Only ZenLedger offers offline functionality, allowing users to review and manage data without an active internet connection.

- Responsive Design: All platforms provide a responsive web interface, ensuring smooth usability on smartphones and tablets even without a dedicated app.

Why Accessibility Matters

These features make it easier for users to manage their crypto tax needs anytime, anywhere. A responsive mobile experience combined with cross-platform syncing ensures seamless transitions between devices, catering to modern, on-the-go lifestyles.

User Ratings Summary for Leading Crypto Tax Software

This table showcases the average user ratings for popular crypto tax software platforms, sourced from trusted review sites like Trustpilot and G2. Ratings provide insights into user satisfaction and software reliability, helping you make an informed decision.

Ratings Breakdown:

- Koinly:

- Trustpilot: 4.7/5

- G2: 4.6/5

- Known for its ease of use and robust features for beginners and advanced users alike.

- CoinLedger:

- Trustpilot: 4.8/5

- G2: 4.7/5

- Praised for its intuitive interface and strong customer support.

- CryptoTaxCalculator:

- Trustpilot: 4.2/5

- G2: 4.1/5

- Offers comprehensive DeFi and NFT tracking but is slightly less user-friendly.

- TokenTax:

- Trustpilot: 4.5/5

- G2: 4.4/5

- Appreciated for its audit support and access to tax professionals.

- ZenLedger:

- Trustpilot: 4.6/5

- G2: 4.5/5

- Known for its multi-year tracking and tailored features for professional traders.

Why Ratings Matter

User ratings reflect real-world experiences, making them an essential consideration when choosing crypto tax software. High ratings often indicate strong performance in areas like ease of use, accuracy, customer support, and security.

By considering user reviews and the overall reputation of crypto tax software, you can confidently choose a platform that has been tested and approved by others. This helps ensure a smoother experience, accurate filings, and effective support throughout your crypto tax journey.

Mobile App and Accessibility

Mobile app functionality and accessibility are increasingly important features in modern crypto tax software. With more investors and traders managing their cryptocurrency portfolios on the go, having a mobile-friendly platform or dedicated app can enhance convenience and streamline tax reporting.

Why Mobile App and Accessibility Matter

Cryptocurrency transactions happen around the clock, often on mobile devices. A crypto tax software with a responsive mobile app or web interface allows users to track their portfolio, sync transactions, and access reports anytime, anywhere. This flexibility is especially beneficial during tax season, when quick access to data and reports can save valuable time.

Accessibility features, such as multi-device support and cross-platform syncing, ensure that users can seamlessly transition between desktop and mobile interfaces without losing progress or data accuracy.

Key Features to Look For

When assessing mobile app and accessibility features in crypto tax software, consider the following:

- Dedicated Mobile App: A native app for iOS and Android devices allows for easy access to tax tools and reports on the go.

- Cross-Platform Syncing: Transactions and data should sync seamlessly across devices, ensuring consistency and up-to-date information.

- Responsive Web Design: For software without a dedicated app, a mobile-optimized web interface is crucial for usability on smartphones and tablets.

- Offline Access: Some mobile apps provide offline capabilities, enabling users to review and manage data without an internet connection.

- User-Friendly Interface: The mobile app should offer intuitive navigation, easy-to-read dashboards, and clear access to key features like transaction summaries, reports, and settings.

Why It’s Important for You

A crypto tax software that offers strong mobile accessibility ensures that you can manage your tax-related tasks wherever you are, without being tied to a desktop computer. This is especially useful for busy professionals or frequent travelers who need flexibility. Additionally, seamless cross-platform syncing reduces the risk of errors and makes the software more convenient to use.

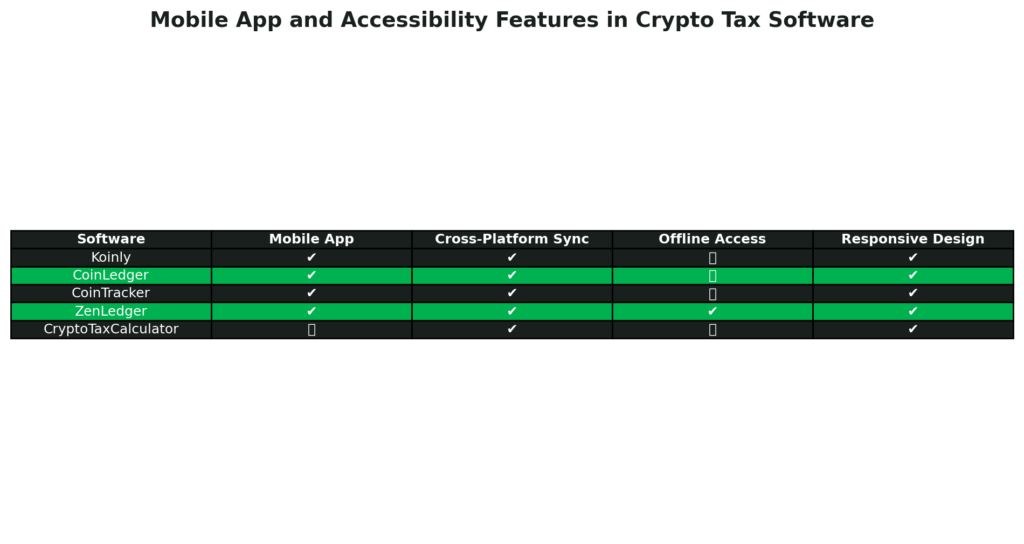

Mobile App and Accessibility Features in Crypto Tax Software

This table compares the mobile app and accessibility features of leading crypto tax software platforms, highlighting key capabilities that enhance user convenience:

Feature Breakdown:

- Mobile App: Most platforms, including Koinly, CoinLedger, CoinTracker (Last Day Offer!), and ZenLedger, provide mobile apps for on-the-go access. CryptoTaxCalculator does not currently offer a mobile app.

- Cross-Platform Sync: All platforms support synchronization across desktop, web, and mobile devices, ensuring consistent data accessibility.

- Offline Access: Only ZenLedger offers offline functionality, allowing users to review and manage data without an active internet connection.

- Responsive Design: All platforms provide a responsive web interface, ensuring smooth usability on smartphones and tablets even without a dedicated app.

Why Accessibility Matters

These features make it easier for users to manage their crypto tax needs anytime, anywhere. A responsive mobile experience combined with cross-platform syncing ensures seamless transitions between devices, catering to modern, on-the-go lifestyles.

By choosing crypto tax software with robust mobile app and accessibility features, you can stay in control of your tax filing process no matter where you are. This flexibility ensures convenience and accuracy, making it easier to keep up with your crypto tax obligations.

Conclusion

Choosing the best crypto tax software can transform a complex and time-consuming process into a streamlined, efficient task. With so many options available, it’s essential to consider the features that matter most to you—whether it’s ease of use, support for a wide range of exchanges and wallets, integration options, or advanced capabilities like DeFi and NFT tracking.

From the comparisons, here are the standout recommendations:

- Best for Beginners: CoinLedger (Still Thinking? Your 10% Off Expires Soon!) offers a user-friendly interface, strong customer support, and affordable pricing, making it an excellent choice for new crypto traders.

- Best for Advanced Users: Koinly excels with its support for complex transactions, multi-year tracking, and robust integration options, ideal for high-volume traders and DeFi users.

- Best for Comprehensive Support: ZenLedger (Save 10% Today Only!) Provides top-notch audit assistance, tax professional access, and 24/7 support, giving users peace of mind throughout the tax season.

Regardless of your needs, all the top crypto tax software options discussed—CoinLedger, Koinly, ZenLedger, TokenTax, and CryptoTaxCalculator, CoinTracker and others—offer unique strengths to cater to various crypto investors. By evaluating these platforms against the key categories discussed in this blog post, you can select a tool that simplifies your tax reporting while ensuring accuracy and compliance.

Pingback: New - Crypto com app review 2024, Do not miss out! - Finance Partner Pro